In the past few months, there has been no shortage of news on mortgage rates in Canada. But all of this talk, has failed to actually explain how these rates are impacting mortgage payments. Knowing there have been rate increases, but prices are trending down; I was curious to see how things compared when looking at April 2022 vs. September 2023.

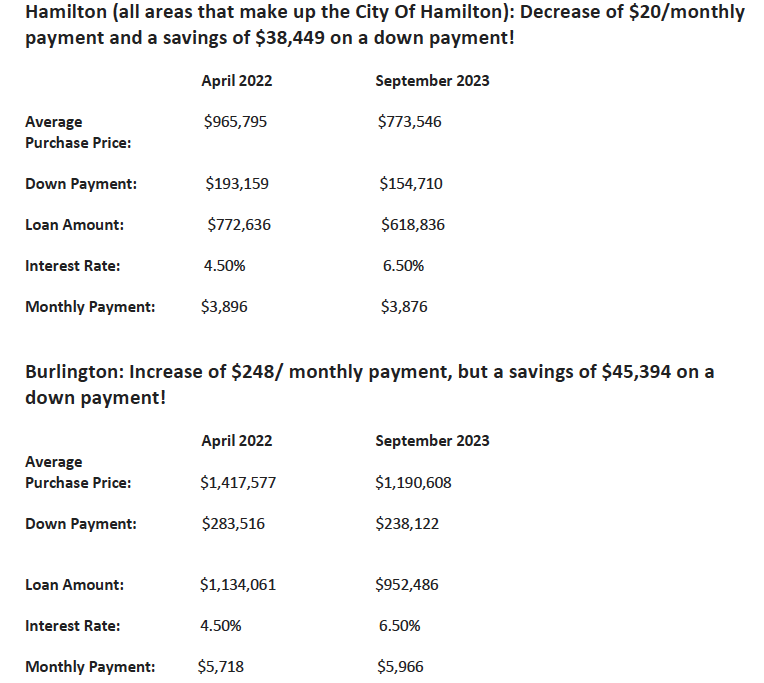

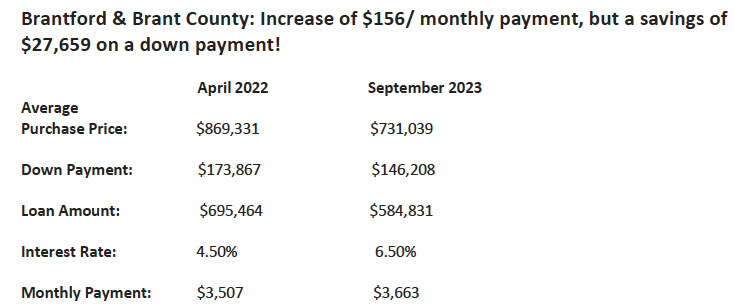

Below are some comparisons for all dwelling types in the following areas: Hamilton (all areas), Burlington, Brantford & Brant County.

Spoiler, but the impact to monthly payments only varies by a few hundred dollars despite the multiple rate hikes! The exception to this finding is Hamilton, where the monthly payment is actually lower now when compared to April 2022.

So, what does all of this mean? The hard costs of getting into a home has decreased, which means you need to borrow less money and save a smaller down payment; land transfer taxes are also lower. The only thing that has increased, is the monthly mortgage payment.

Rates will come down at some point, so if you are able to afford the current mortgage payment within your budget, then why not go out house hunting and take advantage of the market? Another benefit of buying in this market is that conditions are back – I’m seeing offers accepted with 5 business days for financing, home inspection and so on. These are all good things to have in any offer when purchasing a home as it protects the buyer.

If you’re concerned about rates, locking in at the current rate a great option and gives you peace of mind for the term of the mortgage.

Give me a call for a mortgage review and we can determine a comfortable monthly mortgage payment that fits your budget. And if you’re ready to start looking, I’m happy to introduce you to some great Realtors.